ocbc debit card overseas transaction fee|Get travel : 2024-10-07 All overseas transactions are subject to a 3.25% FCY fee. This means that using your OCBC 90°N Card overseas represents buying miles at 1.55 cents each. Zwarte Kleding en Schoenen. Je favoriete adidas klassiekers zijn ook in het zwart verkrijgbaar. Bekijk de collectie van zwarte kleding, schoenen en accessoires in het .

0 · Review: OCBC 90°N Card

1 · OCBC Debit iB

2 · OCBC Debit Card

3 · Major high street bank issues new charge on using a credit card

4 · International credit card use up 63% after Covid

5 · High street bank with 3million customers to start charging fees to use

6 · High street bank to start charging fees to use debit cards abroad

7 · Get travel

8 · Foreign transaction fee: What is it and how to avoid

9 · Fees & Charges for Debit Cards

10 · Debit Card Fee Charge

In samenwerking met StockX heeft Uswitch onderzocht welke stijlen het best verkocht worden op de doorverkoopsite en een lijst met de top 20 modellen gedeeld, .

ocbc debit card overseas transaction fee*******OCBC debit card: OCBC does not have a foreign transaction fee for Mastercard and PayNet debit cards, including the debit card-i options. Your overseas purchase costs are converted back to MYR at the network's exchange rate - which may .

Free cash withdrawal throughout the OCBC ATM network in Singapore, Malaysia and Hong Kong. (T&C applies to customer NYALA). Easier online transaction. Shopping or . MILLIONS of customers at a well-known high street bank will be charged to use their debit cards abroad from today. Metro Bank has introduced a 2.99% fee on all .

Be rewarded when you charge foreign currency transactions to the OCBC 90°N Card. Earn unlimited Miles that never expire at 2.1 Miles for every S$1 spent in foreign currency and .

All overseas transactions are subject to a 3.25% FCY fee. This means that using your OCBC 90°N Card overseas represents buying miles at 1.55 cents each. After August 29, 2024, cash withdrawals made in a foreign currency using your debit card outside the UK will be charged 2.99% on the converted British Pound .

Data from the Reserve Bank of India (RBI) shows a 63% increase in international credit card spending from December 2022 to July 2024, compared to a .From 16 January 2019, all foreign currency transactions are subjected to a currency conversion charge imposed by the respective card associations (1%) and a bank .

ocbc debit card overseas transaction fee Get travelLink your OCBC Debit Card to a Multi-Currency Global Savings Account to avoid foreign currency transaction fees when you make online transactions. Remember to keep sufficient funds in the relevant currencies! 3% of the .ocbc debit card overseas transaction feeFees & Charges for Debit Cards. Transactions Made in Foreign Currencies. Card transactions in foreign currencies (other than USD), will be converted into USD before .Dec 28, 2020 — The foreign transaction fee you’ll pay when using an OCBC card overseas is now a total of 3.25%. That’s made up of a 1% fee levied by your card network, and an additional 2.25% which goes to the bank itself.

Learn how you can fast track your money with the OCBC 360 Account and FRANK Credit Card. Get Started. OR CHECK OUT RECOMMENDED PRODUCTS . You want to play hard and live your best life – we get it. That is why the FRANK Debit Card gives you the freedom to earn rewards on your own terms. . Fees for foreign currency transactions. 3.25% .You can activate Credit and Debit card via OCBC the following channel: Via OCBC Digital. Log in to OCBC Digital app. Tap on the menu bard on the top left of the screen. . (1%) and a bank administrative fee (2%) of the foreign .With the FRANK Debit Card, earn a 1% rebate when you shop, eat and ride. Choose from over 60 stylish card designs. . Fees for foreign currency transactions. 3.25% . Currency conversion fee. 2.80% . Fees for FRANK account. . Terms and Conditions Governing the OCBC Debit Card and FRANK Debit Card Electronic Spend Campaign ;Jan 25, 2024 — OCBC Debit Card: No fee: Not available: Available: Free to use OCBC ATMs Overseas fee of 3% - from 5 SGD to 20 SGD⁵: Up to 3.25%, depending on the linked account: OCBC FRANK Debit Card: Fall below fee may apply once you reach 26 years old: Available: Available: Free to use OCBC ATMs . Overseas fee of 3% - may apply from 5 SGD to 20 SGDCash withdrawal feed changed by other international bank ATM owners overseas. The fee is varied and depends on the policy of each bank owning the ATM. This fee is changed by the customer. . More information regarding transaction settlement process for overseas transportation transactions using OCBC Mastercard Debit Card with contactless and .Annual fee: No annual fee. Replacement card fee: S$20 exclusive of GST (for lost or stolen card only) Overseas ATM cash withdrawal charges: 3% of the transaction amount (Min S$5 and Max S$20). Waived for OCBC ATM network (OCBC, OCBC NISP and OCBC Wing Hang). Fees for foreign currency transactions: 3.25%The OCBC Business Debit Card now comes in a new design! . Transaction Fees . Debit from Foreign Currency Account without Foreign Exchange 从外币账户中扣除(未附带兑换) Same/Third Party: 1/8% commission (min S$10, max S$120) .

Credit Card Fee Waiver. To submit a credit card fee waiver request, please use any of the following options: Via Internet Banking. Login to OCBC Internet Banking ; Go to "Customer Service" Select "Credit card fee waiver" Via Mobile Banking. Login via OCBC Mobile Banking app; Tap on the top left menuThere are no FX fees or no fall-below charge for FX transactions made using your OCBC Debit Card. Simply link the card to your Global Savings Account to start spending. Withdraw cash overseas Save on fees when you use an OCBC debit card to withdraw foreign currency from your Global Savings Account at overseas ATMs.- Service charge RM2.00 per transaction Payment to non-OCBC Bank Accounts . Overseas Conversion Fee - Conversion rate as determined by Mastercard or PayNet, plus any admin fees charged by . Issuance / Annual fees of Business Debit card/i Replacement of Business Debit card/i Waived RM12.00Get travelS$0 cable and commission fee promotion valid till 31 December 2024 for online Overseas Funds Transfer. Agent fee applies and will be variable fees depending upon the remittance amount and currency. Other terms and conditions apply.Title: Fees & Charges for Credit Cards Author: OCBC SG Created Date: 12/13/2023 3:47:48 PM

If your Global Savings Account is linked to your OCBC Debit Card, purchases made in foreign currencies and overseas ATM cash withdrawals will be automatically deducted . subject to a foreign currency transaction fee of 3.25% (comprising a currency conversion charge (1%) imposed by the respective

- Service charge RM2.00 per transaction Payment to non-OCBC Bank Accounts . Overseas Conversion Fee - Conversion rate as determined by Mastercard or PayNet, plus any admin fees charged by . Issuance / Annual fees of Business Debit card/i Replacement of Business Debit card/i Waived RM12.00

S$0 cable and commission fee promotion valid till 31 December 2024 for online Overseas Funds Transfer. Agent fee applies and will be variable fees depending upon the remittance amount and currency. Other terms and .

Title: Fees & Charges for Credit Cards Author: OCBC SG Created Date: 12/13/2023 3:47:48 PM

If your Global Savings Account is linked to your OCBC Debit Card, purchases made in foreign currencies and overseas ATM cash withdrawals will be automatically deducted . subject to a foreign currency transaction fee of 3.25% (comprising a currency conversion charge (1%) imposed by the respectiveAn OCBC Premier Banking customer needs to maintain a minimum average monthly deposit balance of S$200,000 with OCBC Bank at all times. In the event that the customer’s average monthly balance falls below S$200,000, the customer's OCBC Premier World Elite™ Debit Card will be changed to an OCBC Debit Card.A daily transaction limit refers to the total amount that you can pay or transfer in a day. It gives you greater control over how much money moves out of your bank account(s). How it works. You can set daily transaction limits for local and overseas funds transfers and transactions via PayNow, FAST, Pay Any Card, debit cards, eNETS, NETS QR and .

Debit Cards 10 Premier Centre Directory 11 ((23) PB Fees & Charges_Eng_72%_Apr22_R2.ai 2 28/4/22 3:30 PM23) PB Fees & Charges_Eng_72%_Apr22_R2.ai 2 28/4/22 3:30 PM . Standard Fees for all Foreign Currency Deposit Accounts Deposit/withdrawal in foreign currency notes . Premature termination fee OCBC Premier GBP 5,000 HKD 50,000 JPY 500,000 .

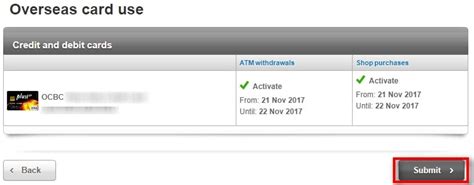

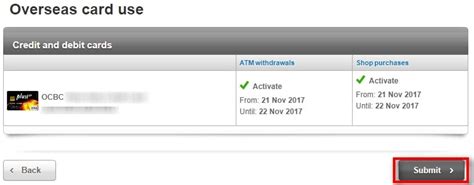

Exclusive perks and rewards await with an OCBC credit or debit card. Compare cards to find one tailored to your spending needs. . EUR, GBP, HKD, JPY, NZD and USD, 24/7 via OCBC Digital, for your overseas transfer, travel payments, online spends . Activate your card’s magnetic stripe for overseas transactions; Apply for online eStatements;OCBC CREDIT CARD & PLUS! DEBIT CARD SUMMARY OF TERMS This section is intended as a consumer guide only. It contains an outline of some pertinent terms . (1%) and a bank administrative fee (2.0%) of the foreign transaction amount. Currency conversion fee An additional fee will be levied on all Visa and MasterCard transactions effected3 days ago — OCBC debit card: OCBC does not have a foreign transaction fee for Mastercard and PayNet debit cards, including the debit card-i options. Your overseas purchase costs are converted back to MYR at the network's exchange rate - which may include a fee - to calculate how much will be debited from your OCBC account to cover the cost.

Annual fee: No annual fee. Replacement card fee: S$20 exclusive of GST (for lost or stolen card only) Overseas ATM cash withdrawal charges: 3% of the transaction amount (Min S$5 and Max S$20). Waived for OCBC ATM network (OCBC, OCBC NISP and OCBC Wing Hang). Fees for foreign currency transactions: 3.25%

Bonus OCBC$ can be earned through transactions made by the principal and supplementary card holder(s). Then, the OCBC$ will be credited to the primary card holder’s OCBC$ account. Once the limit of 10,000 bonus OCBC$ is reached for the month, you will earn the base OCBC$ (i.e. 1 OCBC$ for every S$1 spent) for your transactions.

adidas AG: verzögerte Kurse, Intra-day Chart 5 Tage, Veränderung, Volumen, Charttechnische Indikatoren und Orderhistorie Aktie adidas AG | A1EWWW | .

ocbc debit card overseas transaction fee|Get travel